2024 Can I Deduct Schedule C Losses Against Another Schedule C

If you are looking for How Day Traders Can Deduct All Losses | 1215 Day Trading you’ve came to the right page. We have 15 Pics about How Day Traders Can Deduct All Losses | 1215 Day Trading like How Day Traders Can Deduct All Losses | 1215 Day Trading, Can You Deduct Gambling Losses From Your Taxes? – geek4news and also What Are Schedule C Taxes? — Stride Blog. Here you go:

How Day Traders Can Deduct All Losses | 1215 Day Trading

Photo Credit by: www.1215daytrading.com losses deduct

Can You Deduct Gambling Losses From Your Taxes? – Geek4news

Photo Credit by: geek4news3.blogspot.com gambling deduct losses

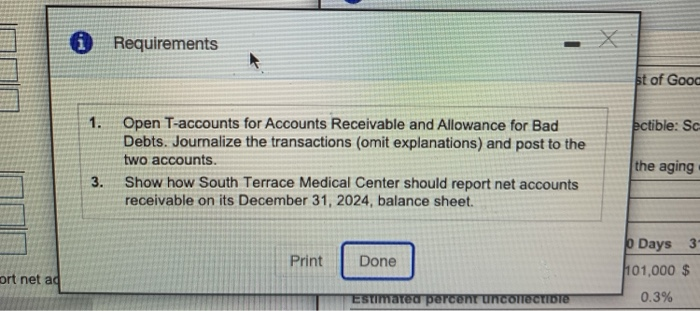

Solved This Question: 1 Pt At September 30, 2024, The | Chegg.com

Photo Credit by: www.chegg.com

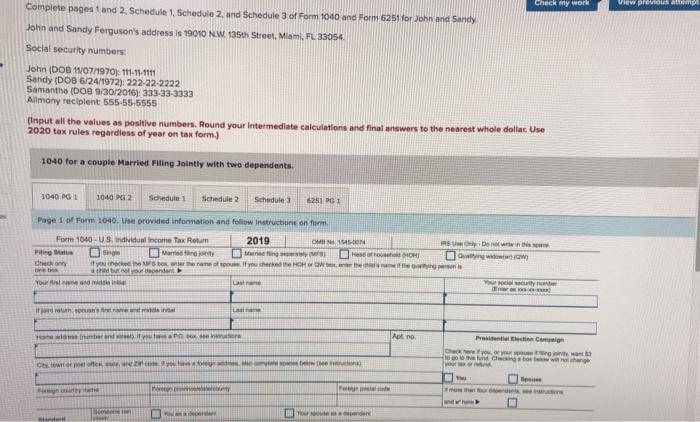

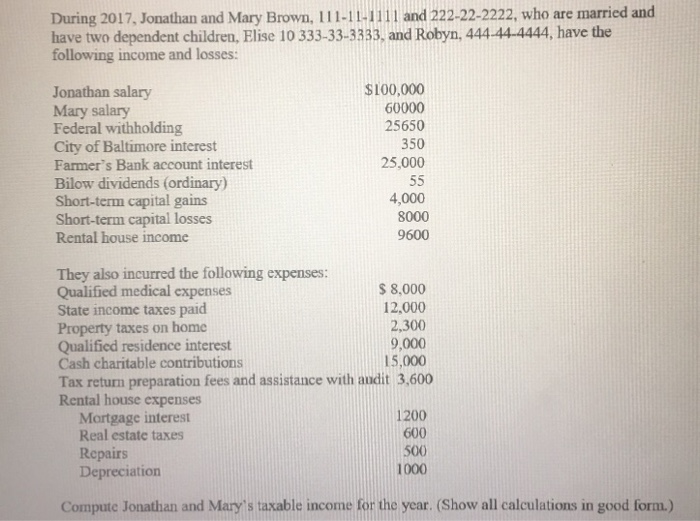

Solved PLEASE SHOW USING A 2017 1040, SCHEDULE A, SCHEDULE | Chegg.com

Photo Credit by: www.chegg.com

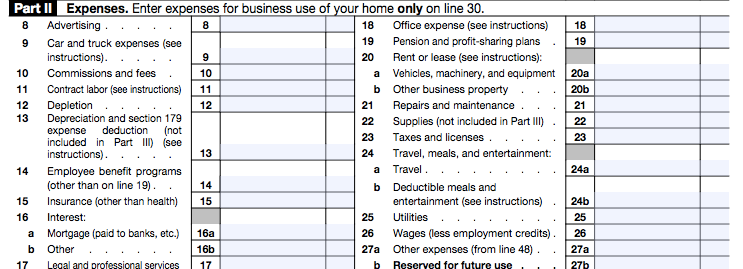

How To Fill Out Schedule C On Form 1040 And Calculate Tax Breaks

Photo Credit by: grow.acorns.com

What Are Schedule C Taxes? — Stride Blog

Photo Credit by: blog.stridehealth.com expenses deduct

The 1040 – The Schedule C: Describe Your Business – Taxes Are Easy

Photo Credit by: taxesareeasy.com

334-Business Expenses-Travel, Meals, And Entertainment

Photo Credit by: www.jdunman.com

Solved A Partially Completed Schedule Of The Company's Total | Chegg.com

Photo Credit by: www.chegg.com

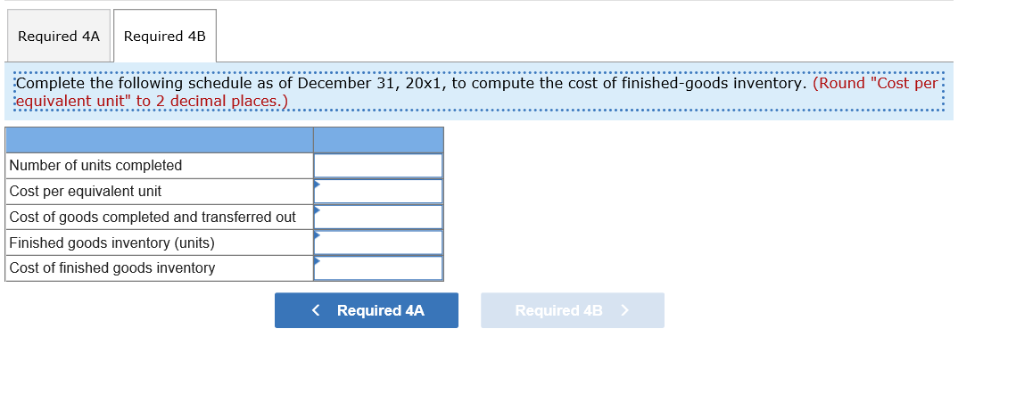

Solved 3. Complete The Following Schedule As Of December | Chegg.com

Photo Credit by: www.chegg.com

Can You Deduct Capital Losses For Income Tax Purposes? – YouTube

Photo Credit by: www.youtube.com

IRS Courseware – Link & Learn Taxes

Photo Credit by: apps.irs.gov irs

Schedule C: The Property You Claim As Exempt | MassLegalHelp

Photo Credit by: www.masslegalhelp.org schedule property exempt worksheet exemptions bankruptcy claim column list federal lists

Can I Deduct Rental Real Estate Losses? – YouTube

Photo Credit by: www.youtube.com

Solved Partial Credit In The Previous Attempt. Required | Chegg.com

Photo Credit by: www.chegg.com solved answer

2024 Can I Deduct Schedule C Losses Against Another Schedule C: Solved 3. complete the following schedule as of december. Gambling deduct losses. How day traders can deduct all losses. Solved this question: 1 pt at september 30, 2024, the. The 1040 – the schedule c: describe your business – taxes are easy. Can you deduct gambling losses from your taxes?